The life of the investment advisor is full of challenges. Robo-advisors, indexing, and other low-cost options have entered the market, and clients are increasingly prepared to question the value of advisory services.

Add to that a reemergence of volatility in riskier asset classes, and life becomes yet more complicated. In choppy or falling markets, clients are prone to behavioral impulses that can harm long-term returns and strain the advisor relationship.

This past October’s rough performance for the major U.S. stock indices is the latest reminder of this dynamic. Meanwhile, investors are cautious about investment grade credit amid rising interest rates. Without clear solutions, advisors are in a tough spot.

While no strategy can fully assure strong advisor-client relations, advisors can adopt strategies that help manage client worries. One such strategy, an even blend of buy-and-hold with tactical asset allocation (also known as trend following, or time series momentum), may help. When clients understand the benefits of a strategy, they are more likely to see the value advisors bring to their portfolios. A 50-50 blend of tactical with buy and hold provides an intuitive explanation in most market conditions, making it easier for advisors to show the value of their approach.

Rising Markets

In steadily rising markets, advisors can present this 50-50 blend as one overall strategy, with each component playing a unique role. Buy-and-hold strategies work well in steadily rising markets, and clients are usually satisfied with their increasing wealth during these good times.

Tactical asset allocation tends to slightly lag buy-and-hold in rising markets. Trend-following models are subject to false risk-off signals, which cause the strategies to underperform buy-and-hold. The cost of these false signals correlates to the volatility of the asset class; more volatile asset classes are more likely to send false signals.

However, in rising markets, advisors can show clients that the buy-and-hold allocation is keeping pace with the broad market, and position any underperformance of the tactical component as a modest sacrifice in the name of conservatism.

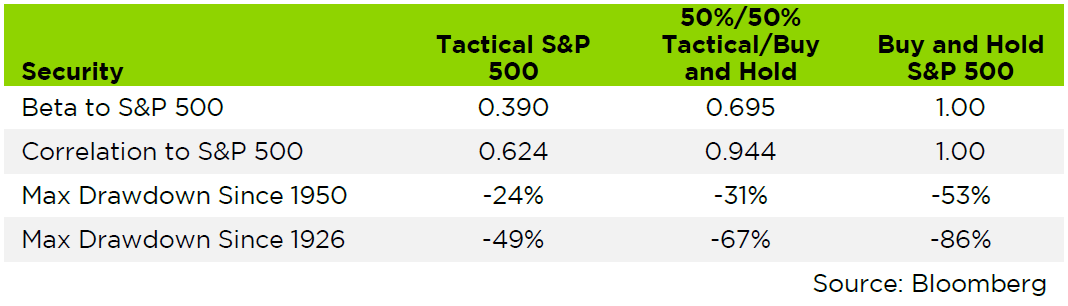

The Tactical S&P 500 strategy is defined here as owning the S&P 500 when it is above its 10 month moving average, and owning 90-day T-bills when the S&P 500 is below its 10 month moving average. The strategy is evaluated and traded at a monthly frequency on the last day of each month. Such a strategy is conceptually similar to using the 200-day moving average as a signal, but avoids extra false signals by lowering trading frequency. The following table illustrates the historical performance since 1929 for pure buy-and-hold, pure tactical allocation, and a 50-50 blend, all applied to the S&P 500.

The advantage of the 50-50 blend appears fairly clear. Its beta to the S&P 500, a measure of how well its returns are explained by the performance of the broad market, is dramatically reduced compared with a pure buy-and-hold strategy. That’s the conservative sacrifice of market returns we discussed. What captures our attention, though, is a strong correlation with the broad market, which may indicate that from a behavioral client perspective, this reduction in returns may be fairly unremarkable. Meanwhile, the 50-50 blend has a major advantage over buy-and-hold when it comes to drawdowns. The trade-off of adding a tactical strategy to buy-and-hold looks worthwhile when studying the long-term rise in the stock market since 1929.

Fluctuating Markets

From the client perspective, buy-and-hold strategies have unremarkable characteristics in flat and fluctuating markets, as investments in risky assets maintain stable levels on net. Tactical allocation models risk underperforming in such environments due to a larger number transactions that ultimately are incorrect. Fluctuations can create false signals to buy or sell. On a relative performance basis, however, a blend of buy-and-hold and tactical asset allocation is unlikely to draw great scrutiny from clients. After all, most strategies that draw returns from exposure to broad markets will, on average, deliver unremarkable returns amid choppy markets.

Tactical investing can be difficult because signals are often incorrect in the short term, creating a pain point between the advisor and their client. This is exactly why tactical investing potentially earns a higher Sharpe ratio – if it was easier, everyone would be doing it, and the rewards to employing such approaches would likely disappear. This can be thought of as a “tactical risk premium.” A blended exposure to buy-and-hold can dampen this pain point, creating a strategy that’s easier for clients to follow.

Falling Markets

The tactical component of a blended asset allocation model shows its true value in times of falling markets. While the buy-and-hold component keeps all of its exposure to portfolio drawdowns, a tactical strategy is designed to go “risk-off” as riskier assets enter a downtrend. Going “risk-off” involves selling out of the stock index position and investing instead in cash or treasury bonds. In smoothly down-trending markets, the tactical component of the portfolio potentially outperforms buy-and-hold, and it does so at the most important behavioral moment for investors – the moment of emotional stress as wealth seems to disappear from the portfolio.

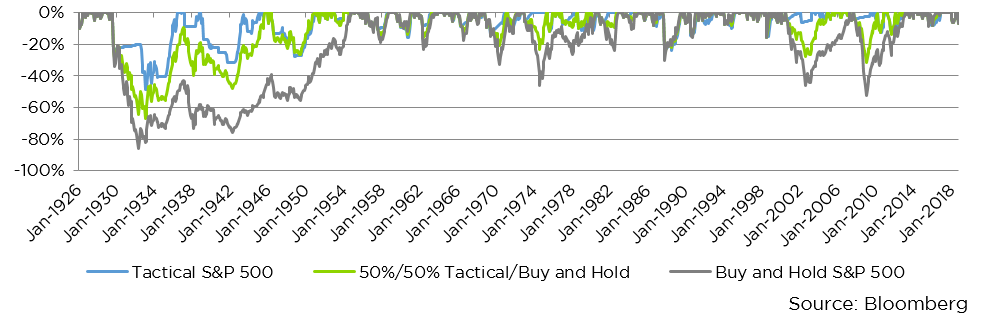

As markets fall, an advisor with a blended allocation to tactical and buy-and-hold strategies can point to overall outperformance of the client’s risky asset portfolio, and remind the client of the decision to allocate a portion of the strategy to the tactical component as it enters a risk-off posture. The following chart illustrates the historical benefits of a blend of tactical allocation with a buy-and-hold strategy.

Portfolio Drawdown

The big picture here is fairly clear. While a blend of tactical asset allocation with buy-and-hold (green) lags a full tactical allocation (blue), such a strategy still has allowed investors to blunt the nastiest effects of a pure buy-and-hold strategy (gray – the one with the really deep drawdowns).

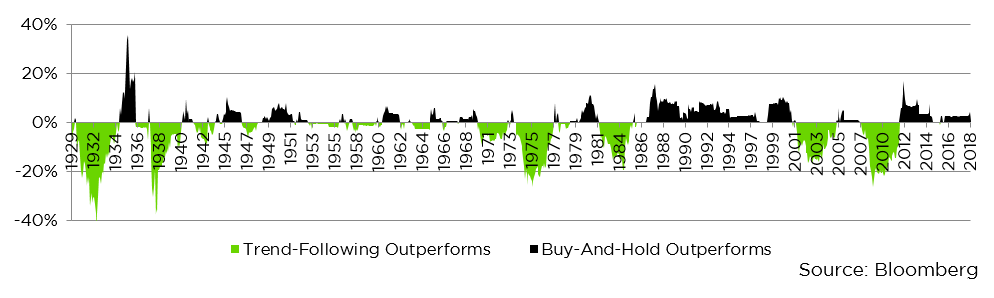

Buy and Hold S&P 500 Versus Trend-Following Rolling 36 Month Outperformance (Annualized)

As displayed above, trend-following and buy-and-hold have essentially swapped back and forth for pole position since 1929, and the extent of outperformance has looked relatively symmetrical in the past 90 years.

Quant or By Feel?

Why use quantitative discipline instead of manager discretion in tactical allocation? History shows how challenging it can be to anticipate which strategy might outperform over a reasonably long investment horizon.

Furthermore, one can easily answer what has happened in the past when using a systematic strategy, where the same doesn’t hold true for discretionary signals. Quantitative allocation models have the virtue of execution discipline and statistical validation – they play by predetermined rules. All of this makes it easier to stick with the system, especially in times of doubt.

As the cliché goes, no one has a crystal ball. Without foreknowledge of which strategy might perform better in the future, an advisor should consider simply splitting the difference by using a blended allocation to quantitative trend following and buy and hold. The advantages, in our minds, are several.

First, a blended strategy entails a modest sacrifice of returns in rising and choppy markets, but that sacrifice is manageable from a client relationship standpoint. Second, the blended strategy’s overall risk-reward profile appears attractive on the basis of long-term expectations.

Finally, and perhaps most important from the investment professional’s perspective, a tactical blend still tends to outperform buy-and-hold during drawdowns, the most critical moment for many client relationships.

We’re unaware of any investment strategy that can completely neutralize risk or drawdowns, or any strategy that makes the advisor-client relationship totally easy. But we do believe that advisors should look for strategies that have strong safeguards against the most challenging market conditions, as well as their clients’ most challenging behavioral tendencies. A 50-50 blend of tactical asset allocation with buy and hold appears to deliver just such an advantage.