Quantitative portfolio decisions can seem mysterious, even to experienced investors. To illustrate how Counterpoint Tactical Equity and Counterpoint Long-Short Equity size up international stocks, we evaluated a few recent individual results from our stock selection model. The stocks discussed may have been fund holdings in the past, but neither fund currently has any position in any specific investment discussed in this piece.

Here we present our model’s rankings of recent top international long and short ideas in terms of an “investment pitch” based on the quantitative factors our model considers.

Long Position: Sino Biopharm (SEHK-1177)

Sino Biopharm’s attractive business and share price momentum make the stock a buy. Shares in the Chinese pharmaceutical company have risen from HKD 4.65 a year ago to HKD 12.70 today – a 173% one-year return. Sino ranked in the top 10% and top 20% for various momentum measures over the intermediate time frame. Contributing to the favorable trend, Sino Biopharm rated strongly on our model’s measure of seasonality, which answers the question, “Is this a good time of the year to own this stock?”

The fundamental side of the story helps. Sino Biopharm ranks in the top decile in our equity funds’ universe for exposure to the profitability anomaly, measured as gross profit divided by total assets. Pharma companies with proprietary drugs are often able to mark up their products substantially, so Sino’s attractive profitability rating is not surprising.

Though little known in the U.S., the company is relatively large and mature. Its U.S. dollar market cap of around $20 billion puts it in the same ballpark as better known drugmaker Mylan (MYL). Sino’s R&D division alone employs 2,000 people, and in China, the company is famous; it has been in Fortune China’s Top 500 Companies in China in 2015 and 2016.

Sino’s main drug for hepatitis generated 2017 sales of RMB 6.5 billion (~$1 billion U.S.) and accounted for 44% of last year’s sales. For context, global hepatitis leader Gilead Sciences (GILD) generated $9.1 billion in global sales in 2017. Sino also sells cardio-cerebral medicines (16% of revenue), oncology medicines (11%), analgesics (11%), and orthopedic medicines (8.4%), among others.

There are reasons a fundamental or value-oriented investor might pass on this stock. With a price to sales ratio of 6.8 according to Bloomberg, the stock has been expensive, and our model ranked it in the bottom 20% for attractive valuation. Sino also has restated its 2016 financials, which might prompt an equity analyst to investigate further.

Regardless, Sino Biopharm rates as having attractive exposure to investment anomalies that historically have contributed to outperformance. In a human analyst’s eyes, the stock rates as a “growth at a reasonable price” stock. Favorable share price trends as well as a robust and growing business outweighed a relatively steep valuation and an expanding balance sheet.

Short Position: Aurelia Metals (ASX-AMI)

Unlike Sino Biopharm, Australian mining company Aurelia Metals has among the worst investment anomaly exposures in our Funds’ universe. An expanding asset base, poor profitability, and a recent ramp up in share price have made the stock fundamentally expensive, creating a short selling opportunity.

As is the case for many mining companies, Aurelia has struggled to manage its balance sheet. Financing mineral extraction through debt creates a steady stream of future obligations. Meanwhile, profits are vulnerable to fluctuating commodity prices and operational difficulties.

Aurelia’s situation is consistent with these concerns. In its annual report the company prominently lists solvency among its primary business risks. Meanwhile, the company earns income from one operating asset. A “lack of asset diversity, together with significant debt amounts, can exacerbate overall risk.”

Aurelia Metals

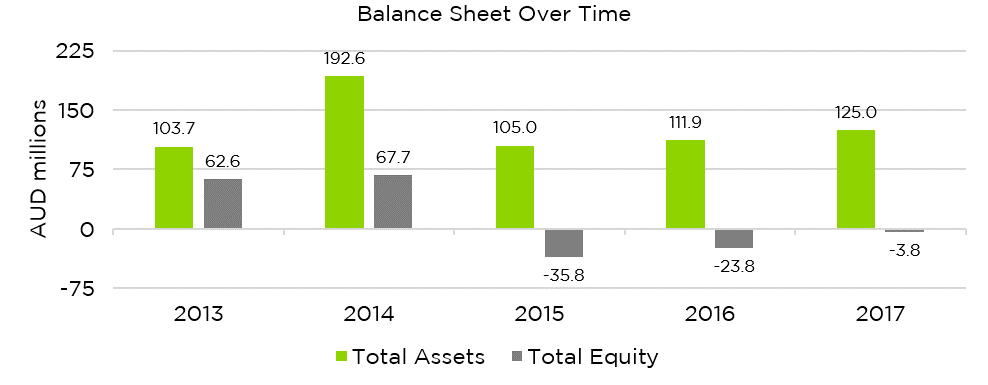

The asset growth factor generally views a growing asset base as a negative. However, a shrinking balance sheet is not necessarily a positive. For instance, in 2015 Aurelia saw its balance sheet cut nearly in half from AUD 193 million to AUD 105 million. This wasn’t shareholder-friendly right-sizing; the company took an AUD 92.9 million impairment charge amid “considerable financial strain” and a legal battle with Swiss mining giant Glencore. Since the 2015 missteps turned Aurelia’s book value negative, the company has been struggling to climb out of the hole, with financing and debt restructuring occupying a large portion of management’s priority list.

Our quantitative model has been unsympathetic to those struggles, rating Aurelia poorly due to growth in total assets since 2015. During that time the balance sheet has expanded 19% to AUD 125 million in total assets at the end of 2017. Some researchers explain the asset growth factor as a mispricing; investors become too optimistic as a company’s asset base grows. That might be happening here; shrinking total liabilities and a recent trend toward positive net worth are superficial signs of a turnaround story.

Meanwhile, investor enthusiasm has prompted the stock to ramp up, bloating the valuation. Shares have risen 273% from a July 2017 low of AUD 15 cents to a recent closing price of AUD 56 cents. The stock thus scores near the top of our momentum ratings, but this is offset by the valuation. For every dollar invested in Aurelia, shareholders can expect about 50 cents in revenue. That places the stock in the bottom quartile in terms of a sales-to-price ratio.

Aurelia looks like a turnaround story that’s gotten ahead of itself as investors have ignored the difficult long term business case, choosing to focus on – and overvalue – potentially fleeting positive developments. Our model combines these and other factors to rate it among the strongest sells in our investment universe.

Conclusion

We have supplemented our model’s outputs with some basic qualitative elements to sketch out how our investment method captures elements of a more conventional, human-driven security analysis. The top and bottom ranked stocks respectively show characteristics that analysts tend to associate with attractive and unattractive investments. Sino Biopharm is a classic GARP story – a stock that’s trending positive and looks expensive at a glance, but whose valuation appears justified by the fundamentals. Aurelia Metals, meanwhile, is a fringe competitor in the cutthroat mining business that’s generating outsize investor enthusiasm relative to its long term prospects – a contrarian short idea.

One benefit of Counterpoint’s investment anomaly driven approach is that it makes these assessments without muddying the waters with the qualitative narrative we have created here. Such “pitches” can lead human analysts and portfolio managers to make behavioral mistakes – succumbing to confirmation bias on companies they have been fond of in the past, or selling winners too early due to loss aversion. Counterpoint’s unsentimental, mechanical approach seeks to mitigate those risks while attempting to capture many of the benefits that have traditionally been associated with bottom-up fundamental security analysis.

Finally, we want to remind readers that anomaly returns can be more pronounced in international stocks vs. U.S. stocks, possibly due to less market efficiency in markets which are less developed than the U.S. We will discuss the significance and character of this phenomenon in an upcoming piece.