Watch Chief Investment Officer & Partner, Michael Krause and Daniel Krause, Head of Sales & Partner at Counterpoint Mutual Funds, provide a winter performance update on Counterpoint’s Fixed...

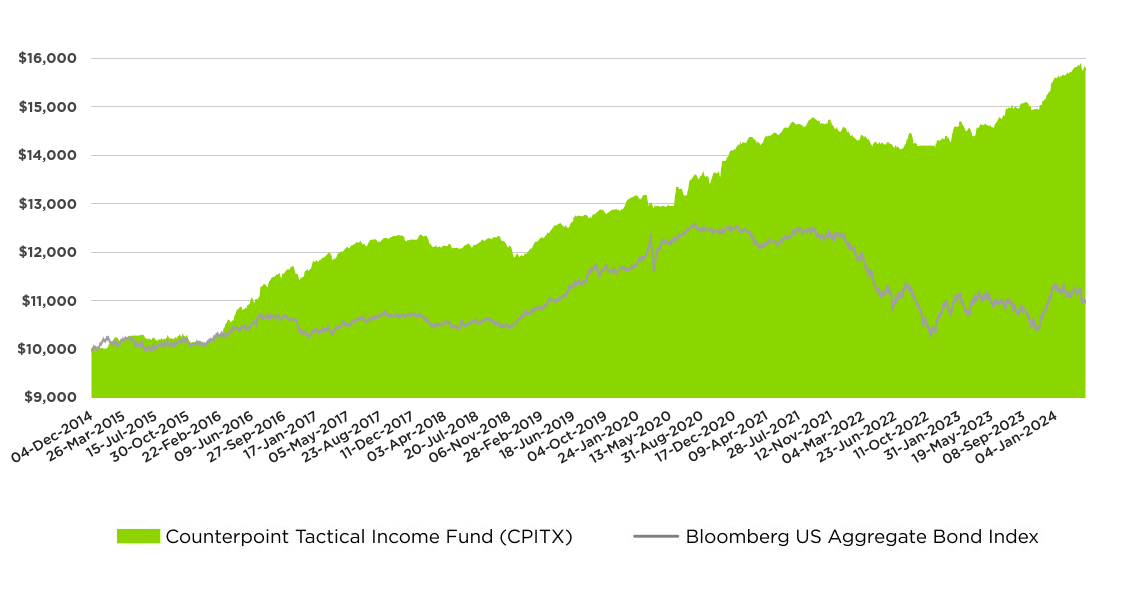

READ MOREThe Fund’s strategy is designed to limit downside portfolio volatility. The Fund aims to provide corporate high-yield like returns during stable or recovering market environments and seeks capital preservation in times of economic uncertainty.

The Fund uses price-driven trend-following models to tactically allocate the portfolio in order to manage risk.

Counterpoint’s empirical research of market history has shown price levels can be an effective predictor of future volatility, and can be utilized to seek an improvement to risk-adjusted returns relative to passive benchmarks.

The Counterpoint Tactical Income Fund aims to provide absolute returns in a stable or recovering market environment and seeks capital preservation in times of economic uncertainty. The Fund uses algorithmic trend-following decision tools to determine when to buy and sell mutual funds and ETFs of high yielding bonds, low duration treasuries, and cash equivalents.

Counterpoint’s process seeks to sell high yielding bond funds in a falling price environment, instead allocating the portfolio to safe haven assets such as low duration treasuries or cash equivalents. When the market price for high yielding bond funds stabilizes and starts rising, the Counterpoint Tactical Income Fund’s quantitative model is designed to recommend the purchase of high yielding assets.

The Counterpoint Tactical Income Fund invests primarily in a portfolio of mutual funds, closed-end funds and passively and actively managed exchange traded funds that invest in (i) high yield instruments (also known as (including bonds, bank loans, floating rate bonds and debt and municipal high yield debt); (ii) U.S. treasuries (with an average duration of

1-5 years); and (iii) cash and cash equivalents (including and money market funds).

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

Watch Chief Investment Officer & Partner, Michael Krause and Daniel Krause, Head of Sales & Partner at Counterpoint Mutual Funds, provide a winter performance update on Counterpoint’s Fixed...

READ MOREAs we pass the start of 2024, the dance of inflation and changing interest rates continues to be top of mind for many investors. With pressure for rate...

READ MOREYear-ahead commentary is challenging for us: We don’t have a crystal ball and we believe predictions contribute more to investment mistakes than outperformance. But the New Year does...

READ MORE

| As of April 16, 2024 | As of March 28, 2024 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Return Since Fund Inception (Annualized) | Year to Date | 1 Year Return | Standard Deviation (Annualized) | Return Since Fund Inception (Annualized) | Year To Date | 1 Year Return | 3 Year Return (Annualized) | 5 Year Return (Annualized) | |

| CPITX | 4.93% | 0.67% | 7.55% | 2.96% | 5.07% | 1.66% | 9.11% | 3.58% | 5.04% |

| CPATX Without Sales Load | 4.68% | 0.61% | 7.18% | 2.96% | 4.82% | 1.60% | 8.73% | 3.33% | 4.78% |

| CPATX With Sales Load (4.5%) | 4.17% | -3.90% | 2.36% | 2.96% | 4.30% | -2.96% | 3.82% | 1.76% | 1.76% |

| CPCTX | 3.93% | 0.35% | 6.35% | 2.96% | 4.05% | 1.35% | 7.90% | 2.55% | 4.00% |

| Bloomberg US Aggregate Bond Index | 0.97% | -3.42% | -1.02% | 4.77% | 1.27% | -0.78% | 1.70% | -2.46% | 0.36% |

The performance data displayed here represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. A shares (CPATX) have a Front-End Sales Charge (commission or “load”) of 4.50%, with lower rates for accounts over $25,000, and 12b-1 distribution fee of 0.25% per year. For performance information current to the most recent month-end, please call toll-free 844-273-8637.

| Ticker | CPATX | CPCTX | CPITX |

|---|---|---|---|

| Share Class | Class A | Class C | Institutional |

| Minimum Investment | $5,000 | $5,000 | $100,000 |

| Minimum IRA Investment | $1,000 | $1,000 | $100,000 |

| Management Fee | 1.25% | 1.25% | 1.25% |

| Other Fund Expenses | 0.29% | 0.29% | 0.29% |

| 12b-1 Distribution & Marketing | 0.25% | 1.00% | None |

| Total Annual Fund Operating Expenses (Including Acquired Fund Expenses of 0.47%) | 2.35% | 3.10% | 2.10% |

| Fund Inception Date | Dec 4, 2014 |

The Fund’s investment adviser has contractually agreed to reduce its fees and/or absorb expenses of the Fund, at least until January 31, 2022 to ensure that the net annual fund operating expenses exclusive of Acquired Fund Expenses will not exceed 2.00%, 2.75%, and 1.75% attributable to Class A, Class C, and Class I shares, subject to possible recoupment from the Fund in future years.

| Top Ten Holdings – as of March 28, 2024 | |

|---|---|

| Fidelity Advisor Floating Rate High Income Fund | 20.49% |

| BlackRock High Yield Bond Portfolio | 13.72% |

| PIMCO High Yield Fund | 13.69% |

| iShares Broad USD High Yield Corporate Bond ETF | 8.63% |

| BlackRock Floating Rate Income Portfolio | 8.46% |

| JPMorgan High Yield Fund | 6.83% |

| Invesco Senior Loan ETF | 6.29% |

| Goldman Sachs High Yield Floating Rate Fund | 6.29% |

| SPDR Blackstone Senior Loan ETF | 3.28% |

| Goldman Sachs Financial Square Government Fund | 2.97% |

| Dividend Rate | Ex Date | Fund Share Class | Long Term Gain | NAV | Pay Date | Record Date | Short Term Gain |

|---|---|---|---|---|---|---|---|

| 0.0535 | 2024-03-27 | Counterpoint Tactical Income I | N/A | 11.29 | 2024-03-28 | 2024-03-26 | N/A |

| 0.0450 | 2024-03-27 | Counterpoint Tactical Income C | N/A | 11.23 | 2024-03-28 | 2024-03-26 | N/A |

| 0.0513 | 2024-03-27 | Counterpoint Tactical Income A | N/A | 11.31 | 2024-03-28 | 2024-03-26 | N/A |

| 0.0552 | 2024-02-28 | Counterpoint Tactical Income I | N/A | 11.24 | 2024-02-29 | 2024-02-27 | N/A |

| 0.0464 | 2024-02-28 | Counterpoint Tactical Income C | N/A | 11.18 | 2024-02-29 | 2024-02-27 | N/A |

| 0.0530 | 2024-02-28 | Counterpoint Tactical Income A | N/A | 11.26 | 2024-02-29 | 2024-02-27 | N/A |

| 0.0474 | 2024-01-30 | Counterpoint Tactical Income I | N/A | 11.25 | 2024-01-31 | 2024-01-29 | N/A |

| 0.0387 | 2024-01-30 | Counterpoint Tactical Income C | N/A | 11.19 | 2024-01-31 | 2024-01-29 | N/A |

| 0.0452 | 2024-01-30 | Counterpoint Tactical Income A | N/A | 11.27 | 2024-01-31 | 2024-01-29 | N/A |

| 0.0675 | 2023-12-18 | Counterpoint Tactical Income I | N/A | 11.19 | 2023-12-19 | 2023-12-15 | N/A |

| 0.0574 | 2023-12-18 | Counterpoint Tactical Income C | N/A | 11.13 | 2023-12-19 | 2023-12-15 | N/A |

| 0.0649 | 2023-12-18 | Counterpoint Tactical Income A | N/A | 11.2 | 2023-12-19 | 2023-12-15 | N/A |

| 0.0491 | 2023-11-29 | Counterpoint Tactical Income I | N/A | 11.07 | 2023-11-30 | 2023-11-28 | N/A |

| 0.0396 | 2023-11-29 | Counterpoint Tactical Income C | N/A | 11.01 | 2023-11-30 | 2023-11-28 | N/A |

| 0.0467 | 2023-11-29 | Counterpoint Tactical Income A | N/A | 11.08 | 2023-11-30 | 2023-11-28 | N/A |

| 0.0399 | 2023-10-30 | Counterpoint Tactical Income I | N/A | 10.9 | 2023-10-31 | 2023-10-27 | N/A |

| 0.0319 | 2023-10-30 | Counterpoint Tactical Income C | N/A | 10.84 | 2023-10-31 | 2023-10-27 | N/A |

| 0.0379 | 2023-10-30 | Counterpoint Tactical Income A | N/A | 10.91 | 2023-10-31 | 2023-10-27 | N/A |

| 0.0558 | 2023-09-28 | Counterpoint Tactical Income I | N/A | 10.97 | 2023-09-29 | 2023-09-27 | N/A |

| 0.0470 | 2023-09-28 | Counterpoint Tactical Income C | N/A | 10.91 | 2023-09-29 | 2023-09-27 | N/A |

| 0.0536 | 2023-09-28 | Counterpoint Tactical Income A | N/A | 10.98 | 2023-09-29 | 2023-09-27 | N/A |

| 0.0635 | 2023-08-30 | Counterpoint Tactical Income I | N/A | 11.08 | 2023-08-31 | 2023-08-29 | N/A |

| 0.0537 | 2023-08-30 | Counterpoint Tactical Income C | N/A | 11.03 | 2023-08-31 | 2023-08-29 | N/A |

| 0.0608 | 2023-08-30 | Counterpoint Tactical Income A | N/A | 11.1 | 2023-08-31 | 2023-08-29 | N/A |

| 0.0518 | 2023-07-28 | Counterpoint Tactical Income I | N/A | 11.08 | 2023-07-31 | 2023-07-27 | N/A |

| 0.0430 | 2023-07-28 | Counterpoint Tactical Income C | N/A | 11.03 | 2023-07-31 | 2023-07-27 | N/A |

| 0.0496 | 2023-07-28 | Counterpoint Tactical Income A | N/A | 11.1 | 2023-07-31 | 2023-07-27 | N/A |

| 0.0608 | 2023-06-29 | Counterpoint Tactical Income I | N/A | 10.99 | 2023-06-30 | 2023-06-28 | N/A |

| 0.0510 | 2023-06-29 | Counterpoint Tactical Income C | N/A | 10.94 | 2023-06-30 | 2023-06-28 | N/A |

| 0.0583 | 2023-06-29 | Counterpoint Tactical Income A | N/A | 11.01 | 2023-06-30 | 2023-06-28 | N/A |

| 0.0582 | 2023-05-30 | Counterpoint Tactical Income I | N/A | 10.89 | 2023-05-31 | 2023-05-26 | N/A |

| 0.0491 | 2023-05-30 | Counterpoint Tactical Income C | N/A | 10.84 | 2023-05-31 | 2023-05-26 | N/A |

| 0.0560 | 2023-05-30 | Counterpoint Tactical Income A | N/A | 10.91 | 2023-05-31 | 2023-05-26 | N/A |

| 0.0462 | 2023-04-27 | Counterpoint Tactical Income I | N/A | 11 | 2023-04-28 | 2023-04-26 | N/A |

| 0.0379 | 2023-04-27 | Counterpoint Tactical Income C | N/A | 10.95 | 2023-04-28 | 2023-04-26 | N/A |

| 0.0441 | 2023-04-27 | Counterpoint Tactical Income A | N/A | 11.01 | 2023-04-28 | 2023-04-26 | N/A |

| 0.0604 | 2023-03-30 | Counterpoint Tactical Income I | N/A | 10.93 | 2023-03-31 | 2023-03-29 | N/A |

| 0.0509 | 2023-03-30 | Counterpoint Tactical Income C | N/A | 10.88 | 2023-03-31 | 2023-03-29 | N/A |

| 0.0580 | 2023-03-30 | Counterpoint Tactical Income A | N/A | 10.95 | 2023-03-31 | 2023-03-29 | N/A |

| 0.0522 | 2023-02-27 | Counterpoint Tactical Income I | N/A | 11 | 2023-02-28 | 2023-02-24 | N/A |

| 0.0444 | 2023-02-27 | Counterpoint Tactical Income C | N/A | 10.95 | 2023-02-28 | 2023-02-24 | N/A |

| 0.0503 | 2023-02-27 | Counterpoint Tactical Income A | N/A | 11.02 | 2023-02-28 | 2023-02-24 | N/A |

| 0.0490 | 2023-01-30 | Counterpoint Tactical Income I | N/A | 11.11 | 2023-01-31 | 2023-01-27 | N/A |

| 0.0409 | 2023-01-30 | Counterpoint Tactical Income C | N/A | 11.06 | 2023-01-31 | 2023-01-27 | N/A |

| 0.0469 | 2023-01-30 | Counterpoint Tactical Income A | N/A | 11.13 | 2023-01-31 | 2023-01-27 | N/A |

| 0.0190 | 2022-12-29 | Counterpoint Tactical Income I | N/A | 10.89 | 2022-12-30 | 2022-12-28 | N/A |

| 0.0145 | 2022-12-29 | Counterpoint Tactical Income C | N/A | 10.84 | 2022-12-30 | 2022-12-28 | N/A |

| 0.0179 | 2022-12-29 | Counterpoint Tactical Income A | N/A | 10.91 | 2022-12-30 | 2022-12-28 | N/A |

| 0.0521 | 2022-12-19 | Counterpoint Tactical Income I | N/A | 10.97 | 2022-12-20 | 2022-12-16 | N/A |

| 0.0422 | 2022-12-19 | Counterpoint Tactical Income C | N/A | 10.92 | 2022-12-20 | 2022-12-16 | N/A |

| 0.0496 | 2022-12-19 | Counterpoint Tactical Income A | N/A | 10.99 | 2022-12-20 | 2022-12-16 | N/A |

| 0.0473 | 2022-11-29 | Counterpoint Tactical Income I | N/A | 11 | 2022-11-30 | 2022-11-28 | N/A |

| 0.0376 | 2022-11-29 | Counterpoint Tactical Income C | N/A | 10.95 | 2022-11-30 | 2022-11-28 | N/A |

| 0.0448 | 2022-11-29 | Counterpoint Tactical Income A | N/A | 11.02 | 2022-11-30 | 2022-11-28 | N/A |

| 0.0155 | 2022-10-28 | Counterpoint Tactical Income I | N/A | 10.99 | 2022-10-31 | 2022-10-27 | N/A |

| 0.0074 | 2022-10-28 | Counterpoint Tactical Income C | N/A | 10.93 | 2022-10-31 | 2022-10-27 | N/A |

| 0.0135 | 2022-10-28 | Counterpoint Tactical Income A | N/A | 11 | 2022-10-31 | 2022-10-27 | N/A |

| 0.0115 | 2022-09-29 | Counterpoint Tactical Income I | N/A | 11 | 2022-09-30 | 2022-09-28 | N/A |

| 0.0025 | 2022-09-29 | Counterpoint Tactical Income C | N/A | 10.95 | 2022-09-30 | 2022-09-28 | N/A |

| 0.0093 | 2022-09-29 | Counterpoint Tactical Income A | N/A | 11.02 | 2022-09-30 | 2022-09-28 | N/A |

| 0.0370 | 2022-08-30 | Counterpoint Tactical Income I | N/A | 11.06 | 2022-08-31 | 2022-08-29 | N/A |

| 0.0270 | 2022-08-30 | Counterpoint Tactical Income C | N/A | 11 | 2022-08-31 | 2022-08-29 | N/A |

| 0.0345 | 2022-08-30 | Counterpoint Tactical Income A | N/A | 11.07 | 2022-08-31 | 2022-08-29 | N/A |

| 0.0262 | 2022-07-28 | Counterpoint Tactical Income I | N/A | 11.07 | 2022-07-29 | 2022-07-27 | N/A |

| 0.0175 | 2022-07-28 | Counterpoint Tactical Income C | N/A | 11.01 | 2022-07-29 | 2022-07-27 | N/A |

| 0.0240 | 2022-07-28 | Counterpoint Tactical Income A | N/A | 11.08 | 2022-07-29 | 2022-07-27 | N/A |

| 0.0248 | 2022-06-29 | Counterpoint Tactical Income I | N/A | 11.03 | 2022-06-30 | 2022-06-28 | N/A |

| 0.0147 | 2022-06-29 | Counterpoint Tactical Income C | N/A | 10.97 | 2022-06-30 | 2022-06-28 | N/A |

| 0.0223 | 2022-06-29 | Counterpoint Tactical Income A | N/A | 11.04 | 2022-06-30 | 2022-06-28 | N/A |

| 0.0282 | 2022-05-27 | Counterpoint Tactical Income I | N/A | 11.16 | 2022-05-31 | 2022-05-26 | N/A |

| 0.0193 | 2022-05-27 | Counterpoint Tactical Income C | N/A | 11.1 | 2022-05-31 | 2022-05-26 | N/A |

| 0.0260 | 2022-05-27 | Counterpoint Tactical Income A | N/A | 11.17 | 2022-05-31 | 2022-05-26 | N/A |

| 0.0195 | 2022-04-28 | Counterpoint Tactical Income I | N/A | 11.18 | 2022-04-29 | 2022-04-27 | N/A |

| 0.0107 | 2022-04-28 | Counterpoint Tactical Income C | N/A | 11.12 | 2022-04-29 | 2022-04-27 | N/A |

| 0.0173 | 2022-04-28 | Counterpoint Tactical Income A | N/A | 11.19 | 2022-04-29 | 2022-04-27 | N/A |

| 0.0046 | 2022-03-30 | Counterpoint Tactical Income I | N/A | 11.17 | 2022-03-31 | 2022-03-29 | N/A |

| 0.0618 | 2021-12-20 | Counterpoint Tactical Income I | N/A | 11.36 | 2021-12-21 | 2021-12-17 | N/A |

| 0.0509 | 2021-12-20 | Counterpoint Tactical Income C | N/A | 11.32 | 2021-12-21 | 2021-12-17 | N/A |

| 0.0590 | 2021-12-20 | Counterpoint Tactical Income A | N/A | 11.37 | 2021-12-21 | 2021-12-17 | N/A |

| 0.0335 | 2021-11-29 | Counterpoint Tactical Income I | N/A | 11.49 | 2021-11-29 | 2021-11-26 | N/A |

| 0.0241 | 2021-11-29 | Counterpoint Tactical Income C | N/A | 11.45 | 2021-11-29 | 2021-11-26 | N/A |

| 0.0311 | 2021-11-29 | Counterpoint Tactical Income A | N/A | 11.5 | 2021-11-29 | 2021-11-26 | N/A |

| 0.0293 | 2021-10-28 | Counterpoint Tactical Income I | N/A | 11.61 | 2021-10-28 | 2021-10-27 | N/A |

| 0.0208 | 2021-10-28 | Counterpoint Tactical Income C | N/A | 11.57 | 2021-10-28 | 2021-10-27 | N/A |

| 0.0271 | 2021-10-28 | Counterpoint Tactical Income A | N/A | 11.62 | 2021-10-28 | 2021-10-27 | N/A |

| 0.0335 | 2021-09-29 | Counterpoint Tactical Income I | N/A | 11.67 | 2021-09-29 | 2021-09-28 | N/A |

| 0.0234 | 2021-09-29 | Counterpoint Tactical Income C | N/A | 11.63 | 2021-09-29 | 2021-09-28 | N/A |

| 0.0309 | 2021-09-29 | Counterpoint Tactical Income A | N/A | 11.68 | 2021-09-29 | 2021-09-28 | N/A |

| 0.0301 | 2021-08-30 | Counterpoint Tactical Income I | N/A | 11.71 | 2021-08-30 | 2021-08-27 | N/A |

| 0.0208 | 2021-08-30 | Counterpoint Tactical Income C | N/A | 11.66 | 2021-08-30 | 2021-08-27 | N/A |

| 0.0278 | 2021-08-30 | Counterpoint Tactical Income A | N/A | 11.71 | 2021-08-30 | 2021-08-27 | N/A |

| 0.0309 | 2021-07-29 | Counterpoint Tactical Income I | N/A | 11.7 | 2021-07-29 | 2021-07-28 | N/A |

| 0.0215 | 2021-07-29 | Counterpoint Tactical Income C | N/A | 11.66 | 2021-07-29 | 2021-07-28 | N/A |

| 0.0286 | 2021-07-29 | Counterpoint Tactical Income A | N/A | 11.71 | 2021-07-29 | 2021-07-28 | N/A |

| 0.0355 | 2021-06-29 | Counterpoint Tactical Income I | N/A | 11.7 | 2021-06-29 | 2021-06-28 | N/A |

| 0.0252 | 2021-06-29 | Counterpoint Tactical Income C | N/A | 11.66 | 2021-06-29 | 2021-06-28 | N/A |

| 0.0329 | 2021-06-29 | Counterpoint Tactical Income A | N/A | 11.71 | 2021-06-29 | 2021-06-28 | N/A |

| 0.0286 | 2021-05-27 | Counterpoint Tactical Income I | N/A | 11.61 | 2021-05-27 | 2021-05-26 | N/A |

| 0.0202 | 2021-05-27 | Counterpoint Tactical Income C | N/A | 11.57 | 2021-05-27 | 2021-05-26 | N/A |

| 0.0265 | 2021-05-27 | Counterpoint Tactical Income A | N/A | 11.62 | 2021-05-27 | 2021-05-26 | N/A |

| 0.0283 | 2021-04-29 | Counterpoint Tactical Income I | N/A | 11.62 | 2021-04-29 | 2021-04-28 | N/A |

| 0.0192 | 2021-04-29 | Counterpoint Tactical Income C | N/A | 11.58 | 2021-04-29 | 2021-04-28 | N/A |

| 0.0260 | 2021-04-29 | Counterpoint Tactical Income A | N/A | 11.62 | 2021-04-29 | 2021-04-28 | N/A |

| 0.0353 | 2021-03-30 | Counterpoint Tactical Income I | N/A | 11.5 | 2021-03-30 | 2021-03-29 | N/A |

| 0.0255 | 2021-03-30 | Counterpoint Tactical Income C | N/A | 11.46 | 2021-03-30 | 2021-03-29 | N/A |

| 0.0328 | 2021-03-30 | Counterpoint Tactical Income A | N/A | 11.51 | 2021-03-30 | 2021-03-29 | N/A |

| 0.0325 | 2021-02-25 | Counterpoint Tactical Income I | N/A | 11.56 | 2021-02-25 | 2021-02-24 | N/A |

| 0.0236 | 2021-02-25 | Counterpoint Tactical Income C | N/A | 11.53 | 2021-02-25 | 2021-02-24 | N/A |

| 0.0303 | 2021-02-25 | Counterpoint Tactical Income A | N/A | 11.57 | 2021-02-25 | 2021-02-24 | N/A |

| 0.0708 | 2021-01-28 | Counterpoint Tactical Income I | N/A | 11.55 | 2021-01-28 | 2021-01-27 | N/A |

| 0.0514 | 2021-01-28 | Counterpoint Tactical Income C | N/A | 11.51 | 2021-01-28 | 2021-01-27 | N/A |

| 0.0658 | 2021-01-28 | Counterpoint Tactical Income A | N/A | 11.56 | 2021-01-28 | 2021-01-27 | N/A |

| 0.0305 | 2020-11-27 | Counterpoint Tactical Income I | N/A | 11.41 | 2020-11-27 | 2020-11-25 | N/A |

| 0.0222 | 2020-11-27 | Counterpoint Tactical Income C | N/A | 11.38 | 2020-11-27 | 2020-11-25 | N/A |

| 0.0284 | 2020-11-27 | Counterpoint Tactical Income A | N/A | 11.42 | 2020-11-27 | 2020-11-25 | N/A |

| 0.0323 | 2020-10-29 | Counterpoint Tactical Income I | N/A | 11.04 | 2020-10-29 | 2020-10-28 | N/A |

| 0.0238 | 2020-10-29 | Counterpoint Tactical Income C | N/A | 11.01 | 2020-10-29 | 2020-10-28 | N/A |

| 0.0301 | 2020-10-29 | Counterpoint Tactical Income A | N/A | 11.05 | 2020-10-29 | 2020-10-28 | N/A |

| 0.0301 | 2020-09-29 | Counterpoint Tactical Income I | N/A | 11 | 2020-09-29 | 2020-09-28 | N/A |

| 0.0207 | 2020-09-29 | Counterpoint Tactical Income C | N/A | 10.97 | 2020-09-29 | 2020-09-28 | N/A |

| 0.0278 | 2020-09-29 | Counterpoint Tactical Income A | N/A | 11.01 | 2020-09-29 | 2020-09-28 | N/A |

| 0.0254 | 2020-08-28 | Counterpoint Tactical Income I | N/A | 11.18 | 2020-08-28 | 2020-08-27 | N/A |

| 0.0170 | 2020-08-28 | Counterpoint Tactical Income C | N/A | 11.15 | 2020-08-28 | 2020-08-27 | N/A |

| 0.0233 | 2020-08-28 | Counterpoint Tactical Income A | N/A | 11.19 | 2020-08-28 | 2020-08-27 | N/A |

| 0.0266 | 2020-07-30 | Counterpoint Tactical Income I | N/A | 11.18 | 2020-07-30 | 2020-07-29 | N/A |

| 0.0167 | 2020-07-30 | Counterpoint Tactical Income A | N/A | 11.19 | 2020-07-30 | 2020-07-29 | N/A |

| 0.0122 | 2020-03-30 | Counterpoint Tactical Income I | N/A | 10.72 | 2020-03-30 | 2020-03-27 | N/A |

| 0.0038 | 2020-03-30 | Counterpoint Tactical Income C | N/A | 10.69 | 2020-03-30 | 2020-03-27 | N/A |

| 0.0102 | 2020-03-30 | Counterpoint Tactical Income A | N/A | 10.72 | 2020-03-30 | 2020-03-27 | N/A |

| 0.0326 | 2020-02-27 | Counterpoint Tactical Income I | N/A | 10.7 | 2020-02-27 | 2020-02-26 | N/A |

| 0.0245 | 2020-02-27 | Counterpoint Tactical Income C | N/A | 10.68 | 2020-02-27 | 2020-02-26 | N/A |

| 0.0305 | 2020-02-27 | Counterpoint Tactical Income A | N/A | 10.71 | 2020-02-27 | 2020-02-26 | N/A |

| 0.0716 | 2020-01-30 | Counterpoint Tactical Income I | N/A | 10.88 | 2020-01-30 | 2020-01-29 | N/A |

| 0.0525 | 2020-01-30 | Counterpoint Tactical Income C | N/A | 10.86 | 2020-01-30 | 2020-01-29 | N/A |

| 0.0668 | 2020-01-30 | Counterpoint Tactical Income A | N/A | 10.88 | 2020-01-30 | 2020-01-29 | N/A |

| 0.0338 | 2019-11-27 | Counterpoint Tactical Income I | N/A | 10.78 | 2019-11-27 | 2019-11-26 | N/A |

| 0.0257 | 2019-11-27 | Counterpoint Tactical Income C | N/A | 10.76 | 2019-11-27 | 2019-11-26 | N/A |

| 0.0318 | 2019-11-27 | Counterpoint Tactical Income A | N/A | 10.79 | 2019-11-27 | 2019-11-26 | N/A |

| 0.0227 | 2019-10-30 | Counterpoint Tactical Income I | N/A | 10.79 | 2019-10-30 | 2019-10-29 | N/A |

| 0.0141 | 2019-10-30 | Counterpoint Tactical Income C | N/A | 10.77 | 2019-10-30 | 2019-10-29 | N/A |

| 0.0205 | 2019-10-30 | Counterpoint Tactical Income A | N/A | 10.8 | 2019-10-30 | 2019-10-29 | N/A |

| 0.0332 | 2019-09-27 | Counterpoint Tactical Income I | N/A | 10.79 | 2019-09-27 | 2019-09-26 | N/A |

| 0.0247 | 2019-09-27 | Counterpoint Tactical Income C | N/A | 10.77 | 2019-09-27 | 2019-09-26 | N/A |

| 0.0310 | 2019-09-27 | Counterpoint Tactical Income A | N/A | 10.8 | 2019-09-27 | 2019-09-26 | N/A |

| 0.0335 | 2019-08-29 | Counterpoint Tactical Income I | N/A | 10.79 | 2019-08-29 | 2019-08-28 | N/A |

| 0.0247 | 2019-08-29 | Counterpoint Tactical Income C | N/A | 10.77 | 2019-08-29 | 2019-08-28 | N/A |

| 0.0313 | 2019-08-29 | Counterpoint Tactical Income A | N/A | 10.8 | 2019-08-29 | 2019-08-28 | N/A |

| 0.0364 | 2019-07-30 | Counterpoint Tactical Income I | N/A | 10.8 | 2019-07-30 | 2019-07-29 | N/A |

| 0.0267 | 2019-07-30 | Counterpoint Tactical Income C | N/A | 10.78 | 2019-07-30 | 2019-07-29 | N/A |

| 0.0340 | 2019-07-30 | Counterpoint Tactical Income A | N/A | 10.8 | 2019-07-30 | 2019-07-29 | N/A |

| 0.0343 | 2019-06-27 | Counterpoint Tactical Income I | N/A | 10.79 | 2019-06-27 | 2019-06-26 | N/A |

| 0.0261 | 2019-06-27 | Counterpoint Tactical Income C | N/A | 10.78 | 2019-06-27 | 2019-06-26 | N/A |

| 0.0322 | 2019-06-27 | Counterpoint Tactical Income A | N/A | 10.8 | 2019-06-27 | 2019-06-26 | N/A |

| 0.0403 | 2019-05-30 | Counterpoint Tactical Income I | N/A | 10.63 | 2019-05-30 | 2019-05-29 | N/A |

| 0.0307 | 2019-05-30 | Counterpoint Tactical Income C | N/A | 10.61 | 2019-05-30 | 2019-05-29 | N/A |

| 0.0377 | 2019-05-30 | Counterpoint Tactical Income A | N/A | 10.64 | 2019-05-30 | 2019-05-29 | N/A |

| 0.0386 | 2019-04-29 | Counterpoint Tactical Income I | N/A | 10.75 | 2019-04-29 | 2019-04-26 | N/A |

| 0.0298 | 2019-04-29 | Counterpoint Tactical Income C | N/A | 10.74 | 2019-04-29 | 2019-04-26 | N/A |

| 0.0364 | 2019-04-29 | Counterpoint Tactical Income A | N/A | 10.76 | 2019-04-29 | 2019-04-26 | N/A |

| 0.0377 | 2019-03-28 | Counterpoint Tactical Income I | N/A | 10.64 | 2019-03-28 | 2019-03-27 | N/A |

| 0.0292 | 2019-03-28 | Counterpoint Tactical Income C | N/A | 10.62 | 2019-03-28 | 2019-03-27 | N/A |

| 0.0356 | 2019-03-28 | Counterpoint Tactical Income A | N/A | 10.64 | 2019-03-28 | 2019-03-27 | N/A |

| 0.0463 | 2019-02-27 | Counterpoint Tactical Income I | N/A | 10.59 | 2019-02-27 | 2019-02-26 | N/A |

| 0.0382 | 2019-02-27 | Counterpoint Tactical Income C | N/A | 10.57 | 2019-02-27 | 2019-02-26 | N/A |

| 0.0442 | 2019-02-27 | Counterpoint Tactical Income A | N/A | 10.59 | 2019-02-27 | 2019-02-26 | N/A |

| 0.0460 | 2019-01-30 | Counterpoint Tactical Income I | N/A | 10.45 | 2019-01-30 | 2019-01-29 | N/A |

| 0.0376 | 2019-01-30 | Counterpoint Tactical Income C | N/A | 10.43 | 2019-01-30 | 2019-01-29 | N/A |

| 0.0436 | 2019-01-30 | Counterpoint Tactical Income A | N/A | 10.45 | 2019-01-30 | 2019-01-29 | N/A |

| N/A | 2018-12-20 | Counterpoint Tactical Income I | 0.1421 | 10.34 | 2018-12-20 | 2018-12-19 | N/A |

| N/A | 2018-12-20 | Counterpoint Tactical Income C | 0.1421 | 10.32 | 2018-12-20 | 2018-12-19 | N/A |

| N/A | 2018-12-20 | Counterpoint Tactical Income A | 0.1421 | 10.34 | 2018-12-20 | 2018-12-19 | N/A |

| 0.0322 | 2018-11-29 | Counterpoint Tactical Income I | N/A | 10.49 | 2018-11-29 | 2018-11-28 | N/A |

| 0.0235 | 2018-11-29 | Counterpoint Tactical Income C | N/A | 10.48 | 2018-11-29 | 2018-11-28 | N/A |

| 0.0297 | 2018-11-29 | Counterpoint Tactical Income A | N/A | 10.49 | 2018-11-29 | 2018-11-28 | N/A |

| 0.0263 | 2018-10-30 | Counterpoint Tactical Income I | N/A | 10.69 | 2018-10-30 | 2018-10-29 | N/A |

| 0.0176 | 2018-10-30 | Counterpoint Tactical Income C | N/A | 10.68 | 2018-10-30 | 2018-10-29 | N/A |

| 0.0241 | 2018-10-30 | Counterpoint Tactical Income A | N/A | 10.7 | 2018-10-30 | 2018-10-29 | N/A |

| 0.0258 | 2018-09-27 | Counterpoint Tactical Income I | N/A | 10.9 | 2018-09-27 | 2018-09-26 | N/A |

| 0.0175 | 2018-09-27 | Counterpoint Tactical Income C | N/A | 10.89 | 2018-09-27 | 2018-09-26 | N/A |

| 0.0239 | 2018-09-27 | Counterpoint Tactical Income A | N/A | 10.9 | 2018-09-27 | 2018-09-26 | N/A |

| 0.0352 | 2018-08-30 | Counterpoint Tactical Income I | N/A | 10.9 | 2018-08-30 | 2018-08-29 | N/A |

| 0.0261 | 2018-08-30 | Counterpoint Tactical Income C | N/A | 10.89 | 2018-08-30 | 2018-08-29 | N/A |

| 0.0329 | 2018-08-30 | Counterpoint Tactical Income A | N/A | 10.91 | 2018-08-30 | 2018-08-29 | N/A |

| 0.0357 | 2018-07-30 | Counterpoint Tactical Income I | N/A | 10.85 | 2018-07-30 | 2018-07-27 | N/A |

| 0.0269 | 2018-07-30 | Counterpoint Tactical Income C | N/A | 10.85 | 2018-07-30 | 2018-07-27 | N/A |

| 0.0335 | 2018-07-30 | Counterpoint Tactical Income A | N/A | 10.86 | 2018-07-30 | 2018-07-27 | N/A |

| 0.0284 | 2018-06-28 | Counterpoint Tactical Income I | N/A | 10.78 | 2018-06-28 | 2018-06-27 | N/A |

| 0.0199 | 2018-06-28 | Counterpoint Tactical Income C | N/A | 10.77 | 2018-06-28 | 2018-06-27 | N/A |

| 0.0262 | 2018-06-28 | Counterpoint Tactical Income A | N/A | 10.79 | 2018-06-28 | 2018-06-27 | N/A |

| 0.0213 | 2018-05-30 | Counterpoint Tactical Income I | N/A | 10.81 | 2018-05-30 | 2018-05-29 | N/A |

| 0.0124 | 2018-05-30 | Counterpoint Tactical Income A | N/A | 10.82 | 2018-05-30 | 2018-05-29 | N/A |

| 0.0181 | 2018-01-30 | Counterpoint Tactical Income I | N/A | 11.01 | 2018-01-30 | 2018-01-29 | N/A |

| 0.0093 | 2018-01-30 | Counterpoint Tactical Income C | N/A | 11.02 | 2018-01-30 | 2018-01-29 | N/A |

| 0.0159 | 2018-01-30 | Counterpoint Tactical Income A | N/A | 11.02 | 2018-01-30 | 2018-01-29 | N/A |

| 0.1547 | 2017-12-21 | Counterpoint Tactical Income I | N/A | 11.01 | 2017-12-21 | 2017-12-20 | 0.0017 |

| 0.0623 | 2017-12-21 | Counterpoint Tactical Income C | N/A | 11.02 | 2017-12-21 | 2017-12-20 | 0.0017 |

| 0.1275 | 2017-12-21 | Counterpoint Tactical Income A | N/A | 11.02 | 2017-12-21 | 2017-12-20 | 0.0017 |

| 0.0361 | 2017-11-29 | Counterpoint Tactical Income I | N/A | 11.16 | 2017-11-29 | 2017-11-28 | N/A |

| 0.0274 | 2017-11-29 | Counterpoint Tactical Income C | N/A | 11.09 | 2017-11-29 | 2017-11-28 | N/A |

| 0.0340 | 2017-11-29 | Counterpoint Tactical Income A | N/A | 11.15 | 2017-11-29 | 2017-11-28 | N/A |

| 0.0321 | 2017-10-30 | Counterpoint Tactical Income I | N/A | 11.28 | 2017-10-30 | 2017-10-27 | N/A |

| 0.0231 | 2017-10-30 | Counterpoint Tactical Income C | N/A | 11.2 | 2017-10-30 | 2017-10-27 | N/A |

| 0.0295 | 2017-10-30 | Counterpoint Tactical Income A | N/A | 11.26 | 2017-10-30 | 2017-10-27 | N/A |

| 0.0279 | 2017-09-28 | Counterpoint Tactical Income I | N/A | 11.28 | 2017-09-28 | 2017-09-27 | N/A |

| 0.0194 | 2017-09-28 | Counterpoint Tactical Income C | N/A | 11.21 | 2017-09-28 | 2017-09-27 | N/A |

| 0.0255 | 2017-09-28 | Counterpoint Tactical Income A | N/A | 11.27 | 2017-09-28 | 2017-09-27 | N/A |

| 0.0313 | 2017-08-30 | Counterpoint Tactical Income I | N/A | 11.27 | 2017-08-30 | 2017-08-29 | N/A |

| 0.0216 | 2017-08-30 | Counterpoint Tactical Income C | N/A | 11.19 | 2017-08-30 | 2017-08-29 | N/A |

| 0.0288 | 2017-08-30 | Counterpoint Tactical Income A | N/A | 11.25 | 2017-08-30 | 2017-08-29 | N/A |

| 0.0293 | 2017-07-28 | Counterpoint Tactical Income I | N/A | 11.3 | 2017-07-28 | 2017-07-27 | N/A |

| 0.0205 | 2017-07-28 | Counterpoint Tactical Income C | N/A | 11.22 | 2017-07-28 | 2017-07-27 | N/A |

| 0.0271 | 2017-07-28 | Counterpoint Tactical Income A | N/A | 11.28 | 2017-07-28 | 2017-07-27 | N/A |

| 0.0381 | 2017-06-29 | Counterpoint Tactical Income I | N/A | 11.21 | 2017-06-29 | 2017-06-28 | N/A |

| 0.0294 | 2017-06-29 | Counterpoint Tactical Income C | N/A | 11.14 | 2017-06-29 | 2017-06-28 | N/A |

| 0.0359 | 2017-06-29 | Counterpoint Tactical Income A | N/A | 11.2 | 2017-06-29 | 2017-06-28 | N/A |

| 0.0456 | 2017-05-30 | Counterpoint Tactical Income I | N/A | 11.29 | 2017-05-30 | 2017-05-26 | N/A |

| 0.0369 | 2017-05-30 | Counterpoint Tactical Income C | N/A | 11.22 | 2017-05-30 | 2017-05-26 | N/A |

| 0.0439 | 2017-05-30 | Counterpoint Tactical Income A | N/A | 11.28 | 2017-05-30 | 2017-05-26 | N/A |

| 0.0352 | 2017-04-27 | Counterpoint Tactical Income I | N/A | 11.25 | 2017-04-27 | 2017-04-26 | N/A |

| 0.0271 | 2017-04-27 | Counterpoint Tactical Income C | N/A | 11.18 | 2017-04-27 | 2017-04-26 | N/A |

| 0.0332 | 2017-04-27 | Counterpoint Tactical Income A | N/A | 11.24 | 2017-04-27 | 2017-04-26 | N/A |

| 0.0350 | 2017-03-30 | Counterpoint Tactical Income I | N/A | 11.17 | 2017-03-30 | 2017-03-29 | N/A |

| 0.0263 | 2017-03-30 | Counterpoint Tactical Income C | N/A | 11.1 | 2017-03-30 | 2017-03-29 | N/A |

| 0.0330 | 2017-03-30 | Counterpoint Tactical Income A | N/A | 11.15 | 2017-03-30 | 2017-03-29 | N/A |

| 0.0161 | 2017-02-27 | Counterpoint Tactical Income I | N/A | 11.22 | 2017-02-27 | 2017-02-24 | N/A |

| 0.0088 | 2017-02-27 | Counterpoint Tactical Income C | N/A | 11.15 | 2017-02-27 | 2017-02-24 | N/A |

| 0.0142 | 2017-02-27 | Counterpoint Tactical Income A | N/A | 11.21 | 2017-02-27 | 2017-02-24 | N/A |

| 0.0248 | 2017-01-30 | Counterpoint Tactical Income I | N/A | 11.09 | 2017-01-30 | 2017-01-27 | N/A |

| 0.0169 | 2017-01-30 | Counterpoint Tactical Income C | N/A | 11.02 | 2017-01-30 | 2017-01-27 | N/A |

| 0.0228 | 2017-01-30 | Counterpoint Tactical Income A | N/A | 11.08 | 2017-01-30 | 2017-01-27 | N/A |

| 0.0664 | 2016-12-22 | Counterpoint Tactical Income I | 0.0360 | 10.94 | 2016-12-22 | 2016-12-21 | 0.1146 |

| 0.0568 | 2016-12-22 | Counterpoint Tactical Income C | 0.0360 | 10.88 | 2016-12-22 | 2016-12-21 | 0.1146 |

| 0.0640 | 2016-12-22 | Counterpoint Tactical Income A | 0.0360 | 10.93 | 2016-12-22 | 2016-12-21 | 0.1146 |

| 0.0328 | 2016-11-29 | Counterpoint Tactical Income I | N/A | 11 | 2016-11-29 | 2016-11-28 | N/A |

| 0.0243 | 2016-11-29 | Counterpoint Tactical Income C | N/A | 10.94 | 2016-11-29 | 2016-11-28 | N/A |

| 0.0307 | 2016-11-29 | Counterpoint Tactical Income A | N/A | 10.99 | 2016-11-29 | 2016-11-28 | N/A |

| 0.0266 | 2016-10-28 | Counterpoint Tactical Income I | N/A | 11.17 | 2016-10-28 | 2016-10-27 | N/A |

| 0.0188 | 2016-10-28 | Counterpoint Tactical Income C | N/A | 11.11 | 2016-10-28 | 2016-10-27 | N/A |

| 0.0250 | 2016-10-28 | Counterpoint Tactical Income A | N/A | 11.16 | 2016-10-28 | 2016-10-27 | N/A |

| 0.0382 | 2016-09-29 | Counterpoint Tactical Income I | N/A | 11.17 | 2016-09-29 | 2016-09-28 | N/A |

| 0.0296 | 2016-09-29 | Counterpoint Tactical Income C | N/A | 11.1 | 2016-09-29 | 2016-09-28 | N/A |

| 0.0359 | 2016-09-29 | Counterpoint Tactical Income A | N/A | 11.15 | 2016-09-29 | 2016-09-28 | N/A |

| 0.0403 | 2016-08-30 | Counterpoint Tactical Income I | N/A | 11.15 | 2016-08-30 | 2016-08-29 | N/A |

| 0.0314 | 2016-08-30 | Counterpoint Tactical Income C | N/A | 11.09 | 2016-08-30 | 2016-08-29 | N/A |

| 0.0378 | 2016-08-30 | Counterpoint Tactical Income A | N/A | 11.14 | 2016-08-30 | 2016-08-29 | N/A |

| 0.0378 | 2016-07-28 | Counterpoint Tactical Income I | N/A | 10.94 | 2016-07-28 | 2016-07-27 | N/A |

| 0.0298 | 2016-07-28 | Counterpoint Tactical Income C | N/A | 10.88 | 2016-07-28 | 2016-07-27 | N/A |

| 0.0357 | 2016-07-28 | Counterpoint Tactical Income A | N/A | 10.93 | 2016-07-28 | 2016-07-27 | N/A |

| 0.0385 | 2016-06-29 | Counterpoint Tactical Income I | N/A | 10.7 | 2016-06-29 | 2016-06-28 | N/A |

| 0.0297 | 2016-06-29 | Counterpoint Tactical Income C | N/A | 10.64 | 2016-06-29 | 2016-06-28 | N/A |

| 0.0363 | 2016-06-29 | Counterpoint Tactical Income A | N/A | 10.69 | 2016-06-29 | 2016-06-28 | N/A |

| 0.0385 | 2016-05-27 | Counterpoint Tactical Income I | N/A | 10.67 | 2016-05-27 | 2016-05-26 | N/A |

| 0.0308 | 2016-05-27 | Counterpoint Tactical Income C | N/A | 10.61 | 2016-05-27 | 2016-05-26 | N/A |

| 0.0365 | 2016-05-27 | Counterpoint Tactical Income A | N/A | 10.66 | 2016-05-27 | 2016-05-26 | N/A |

| 0.0358 | 2016-04-28 | Counterpoint Tactical Income I | N/A | 10.66 | 2016-04-28 | 2016-04-27 | N/A |

| 0.0270 | 2016-04-28 | Counterpoint Tactical Income A | N/A | 10.65 | 2016-04-28 | 2016-04-27 | N/A |

| 0.0328 | 2015-06-29 | Counterpoint Tactical Income I | N/A | 10.03 | 2015-06-29 | 2015-06-26 | N/A |

| 0.0276 | 2015-06-29 | Counterpoint Tactical Income C | N/A | 10.03 | 2015-06-29 | 2015-06-26 | N/A |

| 0.0309 | 2015-06-29 | Counterpoint Tactical Income A | N/A | 10.03 | 2015-06-29 | 2015-06-26 | N/A |

| 0.0263 | 2015-05-28 | Counterpoint Tactical Income I | N/A | 10.17 | 2015-05-28 | 2015-05-27 | N/A |

| 0.0200 | 2015-05-28 | Counterpoint Tactical Income C | N/A | 10.16 | 2015-05-28 | 2015-05-27 | N/A |

| 0.0253 | 2015-05-28 | Counterpoint Tactical Income A | N/A | 10.17 | 2015-05-28 | 2015-05-27 | N/A |

| 0.0305 | 2015-04-29 | Counterpoint Tactical Income I | N/A | 10.17 | 2015-04-29 | 2015-04-28 | N/A |

| 0.0228 | 2015-04-29 | Counterpoint Tactical Income C | N/A | 10.16 | 2015-04-29 | 2015-04-28 | N/A |

| 0.0288 | 2015-04-29 | Counterpoint Tactical Income A | N/A | 10.17 | 2015-04-29 | 2015-04-28 | N/A |

| 0.0262 | 2015-03-30 | Counterpoint Tactical Income I | N/A | 10.08 | 2015-03-30 | 2015-03-27 | N/A |

| 0.0200 | 2015-03-30 | Counterpoint Tactical Income C | N/A | 10.08 | 2015-03-30 | 2015-03-27 | N/A |

| 0.0248 | 2015-03-30 | Counterpoint Tactical Income A | N/A | 10.08 | 2015-03-30 | 2015-03-27 | N/A |

| 0.0220 | 2015-02-26 | Counterpoint Tactical Income I | N/A | 10.19 | 2015-02-26 | 2015-02-25 | N/A |

| 0.0221 | 2015-02-26 | Counterpoint Tactical Income C | N/A | 10.18 | 2015-02-26 | 2015-02-25 | N/A |

| 0.0200 | 2015-02-26 | Counterpoint Tactical Income A | N/A | 10.19 | 2015-02-26 | 2015-02-25 | N/A |

Two contrasting risk exposures are presented in the above Tactical Versus Passive presentation: high yield corporate bonds and “risk-free” cash. The ICE BofA Merrill Lynch High Yield Bond Master II® Index is an unmanaged index that tracks the performance of below investment grade U.S. denominated corporate bonds publicly issued in the U.S. domestic market. The referenced index is shown for general market comparisons and are not meant to represent the Fund. The securities that belong to this index are considered to be high-risk investments. Risks include the greater risk of loss, sensitivity to interest rate and economic changes, valuation difficulties, liquidity, credit quality, and new legislation risk. The green “Tactical” line represents alternating allocation to high yield corporate bonds and cash and their respective associated risks, while the black “Passive” line represents a permanent allocation to high yield corporate bonds and their above mentioned risks.

Mutual Funds involve risk including the possible loss of principal. The use of leverage by the Fund or an Underlying Fund, such as borrowing money to purchase securities or the use of derivatives, will indirectly cause the Fund to incur additional expenses and magnify the Fund’s gains or losses. Derivative instruments involve risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional investments. There is a risk that issuers and counterparties will not make payments on securities and other investments held by the Fund, resulting in losses to the Fund.

In general, the price of a fixed income security falls when interest rates rise. The Fund may invest in high yield securities, also known as “junk bonds.” High yield securities provide greater income and opportunity for gain, but entail greater risk of loss of principal. When the Fund invests in other investment companies, including ETFs, it will bear additional expenses based on it’s pro rata share of the other investment company’s or ETF’s operating expenses, including the potential duplication of management fees. The risk of owning an investment company generally reflects the risks of owning the underlying investments the investment company holds. The Fund will use model-based strategies that, while historically effective, may not be successful on an ongoing basis or could contain unknown errors. In addition, the data used in models may be inaccurate.

© 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5516-NLD-09/01/2021

We’ve received your request for the featured event collateral. A Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your meeting request and a Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your event registration request and will be in touch shortly.

Subscribe to stay up to date on Counterpoint Funds and receive our monthly perspective.

We have received your application and look forward to reviewing your qualifications for the role. If your application seems like a good fit, we will contact you to discuss next steps.

Thank you again for your application and interest in joining the Counterpoint team!

We’ve received your message. A Counterpoint Funds team member will contact you soon.

Subscribe to stay up to date and receive our monthly perspective.