Counterpoint Tactical Equity and Counterpoint Long-Short Equity funds are built on confidence in the advantages of adding international names to our multifactor long-short stock portfolios. This raises the question: Why go invest in Japan, Germany, or Australia when there are plenty of opportunities right here in the U.S.? As it turns out, international factor-based investing has several important advantages:

- International long-short factor strategies have recently faced better opportunities than their U.S.-only counterparts.

- Investor “home bias” should drive persistent opportunities for international long-short strategies going forward.

- Good, old-fashioned diversification: Imperfect correlation across international equity markets helps improve the risk adjusted return of global portfolios.

As a reminder: factors, or anomalies, are investment characteristics that have historically explained outperformance or underperformance of stocks. For example, a stock that’s expensive relative to the sales its company generates tends to underperform over time, while a cheap stock relative to sales tends to outperform over time.

A friendly current environment

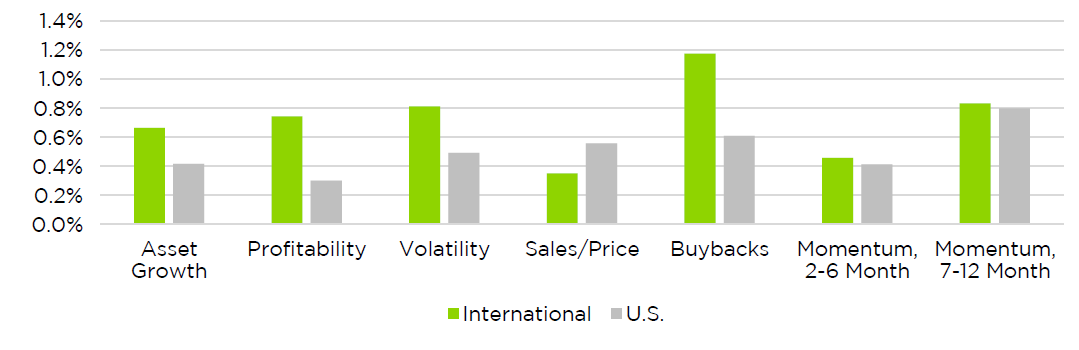

Since the Great Financial Crisis of 2008-2009, returns to factor-style investments in international stocks have been at least as strong as returns to factor-style investments in U.S. stocks. From 2010 to 2017, returns to international investments in factors such as asset growth, profitability, volatility, and share buybacks have all far outpaced the returns to those strategies applied in the U.S. Perhaps volatility is the only exception, where low-volatility U.S. stocks disproportionately benefited from a secular drop in interest rates over the same period.

Investment Anomaly Returns, 2010-2017

When the long-only component of many factor-based strategies are having some trouble stateside, it’s comforting to find that there are robust opportunities for investors who are willing to look outside U.S. borders.

Solid long-term performance

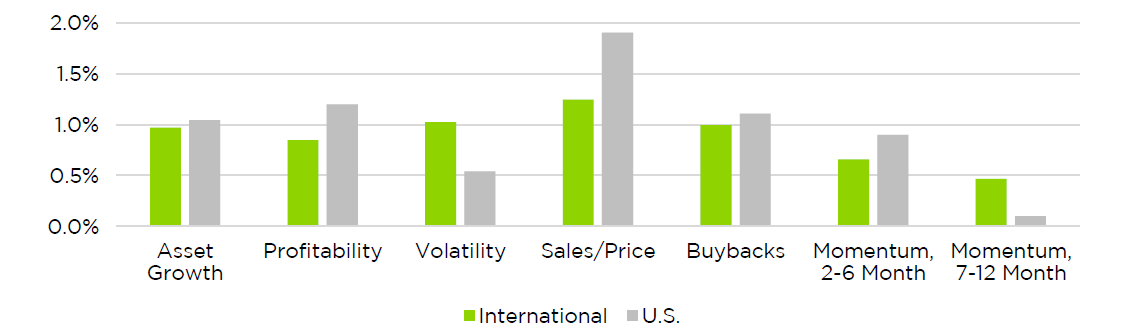

International stock mispricing opportunities have not always so dramatically outshone their domestic counterparts. Still, from 2000 to today international stocks have provided plenty of opportunities for factor-driven strategies. Returns to sales to price, and momentum anomaly strategies have been comparable between U.S. and international stocks over the past couple of cycles.

Investment Anomaly Returns, 2000-2017

Even if international stocks revert back to their longer-term track record compared to U.S. stocks, they should still provide reasonable opportunities for factor-based strategies. In any case, we believe there are other long-term advantages to Counterpoint Equity funds’ international exposure.

‘Home bias’ creates persistent opportunities

Research suggests that investors tend to invest a large majority of their assets in their own countries. Some of this can be attributed to the costs of finding suitable international investments. However, this “home bias” may also owe to irrationalities built into human psychology. To illustrate, this 1991 paper finds that “More than 98% of the equity portfolio of Japanese investors is held domestically; the analogous percentages are 94% for the U.S., and 82% for Britain.”[1] It’s hard to imagine that such portfolios are optimal, since investors in each country are overlooking so many global opportunities. This home bias can create opportunities in countries with less investment capital, regulatory or technical barriers to capital flows, and less financial infrastructure. And if human psychology is the driver, there’s reason to believe this dynamic will persist for a long time to come.

Note: In conducting the research for this piece, we also saw some interesting differences in anomaly factor performance between small international stocks and their midsize and larger counterparts. We will address some of those findings in a subsequent piece.

Diversification

It’s almost boring to cite one of the most universally accepted portfolio strategies, but humor us, please: International investments create diversification benefits. Long-short International factor strategies exhibit low correlation to the same factors in the US, while still having positive expected returns. Adding international factor exposure to a portfolio has historically improved risk-adjusted portfolio returns.

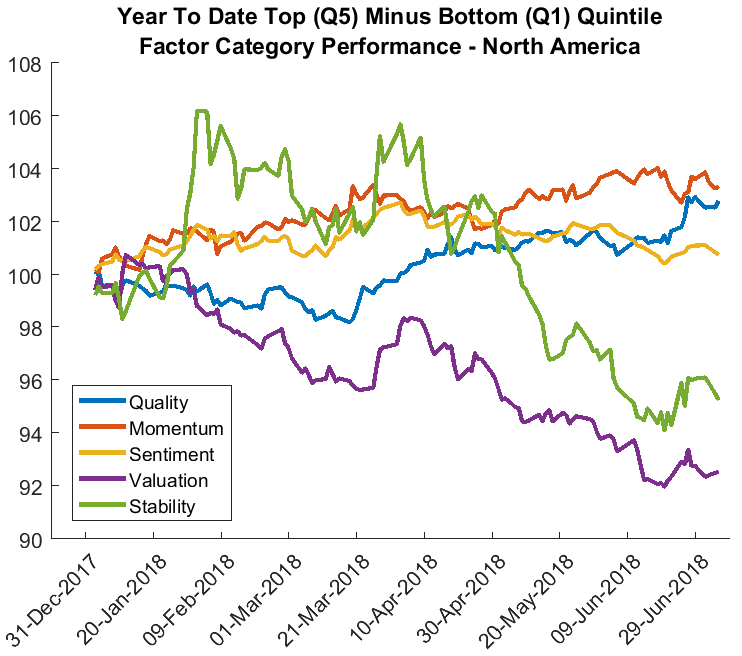

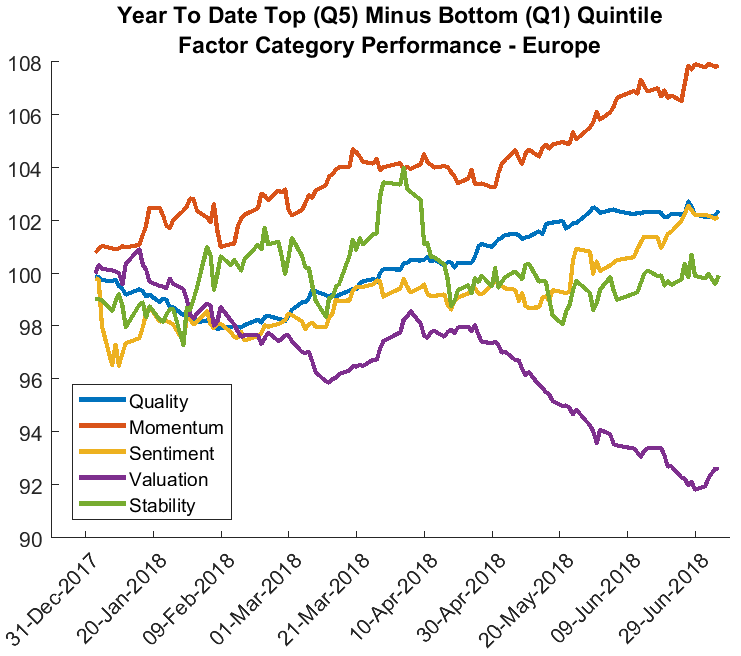

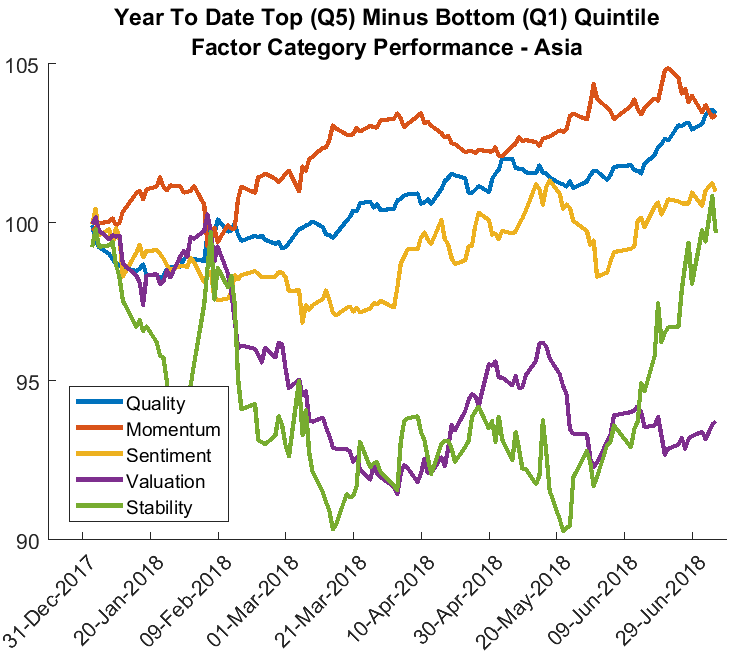

To take a recent example, value and stability factor categories performed poorly in the U.S. in May and June. Meanwhile their Asian and European counterparts had mixed to even negatively correlated results in the same period. This dampened the negative impact from such a pronounced move in U.S. value and stability categories, smoothing out the inevitable drawdowns that occur to any strategy in the short-term.

Conclusion

There’s strong support for Counterpoint Equity Funds’ international factor-based investment strategy. In our current environment, investment anomalies have been more pronounced in international stocks than domestically, suggesting a strong driver of recent portfolio performance.

Over the longer term, international factor strategies have performed as well when applied to international stocks as they have in the U.S., and investors’ psychological tendency to focus on their home countries suggests continued opportunities in global stocks. And, of course, diversification is a persistent and reliable driver of strong risk-adjusted performance. While staying close to home is comforting, the benefits afforded by international opportunities are too great to pass up.

[1] Popmpian, Michael M., Colin McLean, Alistair Byrne. “Behavioral Finance and Investment Processes.” In Behavioral Finance, Individual Investors, and Institutional Investors.Charlottesville, VA. Association for Investment Management and Research.